It is juggling knives to deal with five different debts. You miss payments. Forget due dates. Anxiety about which bill to pay initially. Debt consolidation concentrates all those ills into a single package.

One pay, one interest, one deadline. Simple. However, lenders will not give loans to just anyone. Their credit history will tell them whether you will repay them. They verify your income to determine whether you are able to make the payments. They examine the amount you have been owing. At least with an idea of what the lenders want, you have a chance to fight.

What Is a Debt Consolidation Loan?

A debt consolidation loan lets you turn many bills into just one. You borrow enough to pay off your existing debts, then make a single payment each month. Most come with fixed rates, so your payment stays the same until you’ve paid it off.

You can use these loans to clear credit cards, medical bills, or other personal loans. The main goal? Getting a lower rate and making your life simpler. You can also get debt consolidation loans for bad credit with low interest. The lenders recognise that many people need help getting back on track. These loans help you pay off your loans at much lower rates, like refinancing.

These loans typically run for 3-7 years. You’ll know exactly when you’ll be debt-free from the start. No more guessing or struggling with multiple due dates.

- Pay less interest over time with the right loan

- Track your progress more easily with one balance

- Stop collection calls from multiple creditors

- Create a clear path to becoming debt-free

Credit Score Requirements in Ireland

| Credit Rating | Central Credit Register Status | Approval Odds | Typical APR Range |

| Excellent | No missed payments, low debt | Very high | 6.5% – 8.5% |

| Good | 1-2 minor issues, mostly clean | High | 8.5% – 12% |

| Fair | Some late payments, managed debt | Moderate | 12% – 18% |

| Poor | Multiple missed payments | Low | 18% – 23% |

| Very Poor | Defaults, CCJ, bankruptcy | Very low | May need secured loan |

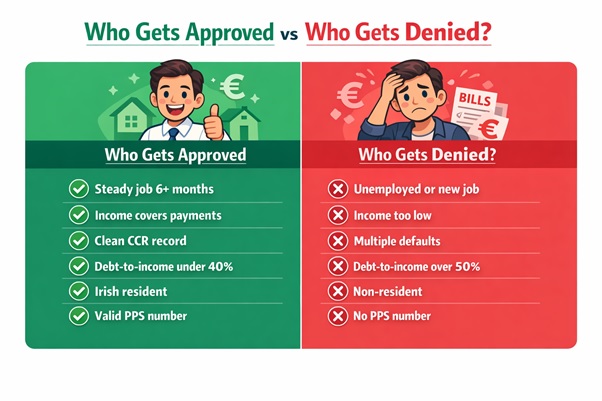

Who Actually Qualifies for These Loans?

The lenders want to see that you have steady money coming in to cover payments. Most prefer credit scores of 580 or higher, but this isn’t a hard rule. Your debt compared to your income matters so you also aim to keep this under 50%.

You’ll need proof of employment and address. A clean credit history helps, but even a record that shows recent improvement can work. There are also many loans in Ireland with bad credit options available through special lenders who look at your whole situation, not just your score.

The application process usually takes just a few days from start to finish. Nowadays, almost all loan providers give you the facility to fill out loan applications online, which will save you both time and trouble.

- Proof of identity and address needed (valid passport or driving license)

- Recent payslips or tax returns show your ability to repay

- Bank statements help lenders see your spending habits

- Self-employed applicants should bring business accounts

- Most lenders require you to be at least 18 years old

Can You Get Approved with Bad Credit?

Yes, you can still get a consolidation loan with poor credit. You’ll likely pay higher interest rates. Many lenders see past credit troubles if you can show things are different now.

Secured loans offer one path forward. You lower the lender’s risk by putting up something valuable like your car or savings as security. This often leads to better rates and higher approval chances.

You can also add a co-signer with better credit to improve your odds. This person agrees to pay if you can’t, which gives lenders more confidence.

The direct lenders often work with members who have credit challenges. They look at your spending history and may be more understanding than banks. The online lenders now focus on helping people with credit issues.

- Community-based lenders often have more flexible criteria

- Showing recent on-time payments helps overcome past mistakes

- Some lenders specialise in second-chance lending

- Credit counselling services can connect you with suitable options

- Comparing at least three offers helps find the best terms

Will Applying Hurt Your Credit Score?

When you apply, lenders check your credit report. This is called a hard inquiry. Each one typically drops your score by 5-10 points.

Many lenders offer pre-qualification using a “soft pull” that doesn’t affect your score at all. This lets you check rates without commitment. You can use this option whenever possible.

You can make on-time payments on your new loan to rebuild your credit over time. Plus, paying off credit cards lowers your utilisation ratio – how much of your available credit you’re using. This often boosts your score within months.

Most people see their scores recover quickly after consolidation. The initial dip from applying is small compared to the potential benefits of getting your debt under control.

- Request pre-qualification before formal applications whenever possible

- Apply to multiple lenders within a 14-day window to count as just one inquiry

- Your payment history makes up 35% of your credit score – consolidation helps manage this

- Keeping old accounts open maintains your credit history length

- Monitor your credit report regularly to track improvements

Debt consolidation works best when you have a plan to avoid building up new debt. The main benefit comes from simplifying your payments while potentially saving on interest.

Before applying, add up all your current monthly payments. With this, you can compare the offers to those from consolidation lenders to make sure that you are really going to save money. Some lenders have hidden fees that prevent you from making much of a saving, so make sure you read the terms and conditions carefully.

Conclusion

Debt is not to be taken control of; it is to make prudent decisions about consolidation. You have noticed the alternatives, secured loans down to credit union offerings.

You are the first to know your score, even before a lender. Next, decide on at least three loan offers before you pick one. Be aware of the added cost, which swallows your savings. The loan will fix the current issue; however, it will be tomorrow, and your financial well-being will depend on how you spend the money.

Caleb works as a senior content writer at Loanstopocket for the past 3 years. He is a writing enthusiast and invests a good time in exploring and writing about financial trends. His keenness in exploring a topic to create a research-based piece is simply unmatched. He believes in including a texture of authenticity with real-time examples and facts.

Caleb’s blogs and articles reveal deep-seated knowledge and expertise. His educational qualification forms the base of his excellent command over the industry and Jargon. He is a postgraduate in Finance and is currently involved in exploring the world of the stock market.