The roof repair is usually more expensive. The amount many households can afford at a single time. The prices per bill are between 3,000 and 12,000 euros. You can take loans to cover the cost. You can pay them off with small monthly payments. This will keep your house dry without emptying your checking account in one night. The perfect loan matches your salary and does not extend the payment to the limit of comfort.

Why Roof Repairs Cost So Much in Ireland?

The climate exacts a ruthless price on roofs year after year. Its weather onslaught causes concealed leaks that decay wooden beams in the long run.

Prices of materials have increased by almost 35% since 2022. Certain fundamental roof tiles are priced twice what they used to be three years ago. Most construction workers today demand €75-95 for an hour, compared to €55-65 in 2021.

The roofers pay high rates to come out in the rain when your ceiling begins dripping at midnight. You don’t want to wait for simple repairs to turn into a problem of major structural proportions. Most houses have complicated roof architecture that takes specialised skills. The roofers must have proper safety gear and insurance.

1. Hidden Roof Costs Many Overlook

- Scaffolding rental often costs €1,000+ for typical jobs

- Skip hire for waste removal adds €300-450

- Building permits for larger repairs cost €200-350

- Protective treatments add 15-20% to overall costs

- Insurance excess payments typically start at €500

|

Things to Check Before Loan Approval | ||

|

Checkpoint |

Why It Matters |

Example |

|

Total repayable |

Real cost of the loan, not just the monthly |

€10,000 loan at 8% over 5 years = €12,165 |

|

Fixed vs variable rate |

Impacts future payments |

Fixed is safer for the budget |

|

Early repayment fee |

Can add cost if clearing the loan early |

Some lenders charge 1–2 months’ interest |

|

Lender credibility |

Avoid scams, hidden costs |

Check the Central Bank of Ireland register |

2. Where Can I Get a Quick Loan?

Many online direct lenders now offer loans that hit your account within hours. These companies skip the middleman and deal with you straight away. Many approve loans even if your credit isn’t perfect.

Banks still offer quick loans, but expect more paperwork and waiting. Some direct lenders focus on small amounts from €100 to €2,500. Others handle bigger sums up to €25,000 for home fixes or car buys. The application takes about 10 minutes on most lender websites.

You always check if the lender has proper Central Bank of Ireland approval. The real direct lenders never ask for upfront fees before giving loans. You can compare at least three offers before picking one to sign.

3. What to Watch for with Quick Loans?

- Higher interest on faster loans (often 15-25% APR)

- Hidden fees like early repayment charges

- Shorter payback times that increase monthly payments

- Automatic renewal traps that keep you paying

- Loan amounts that grow beyond what you truly need

What Loan Types Work Best for Roof Repairs?

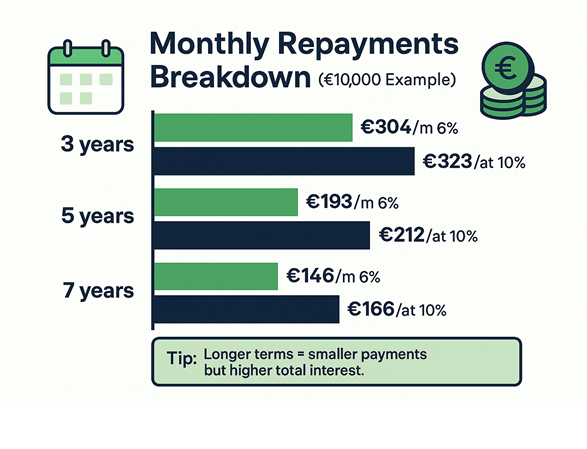

The best loan choice depends on how much you need, how fast you need it, and what you can afford monthly. Most homeowners can choose the best home renovation loans when facing costly roof repairs.

1. Unsecured Personal Loans

These loans come through fast, often within 24-48 hours after approval. You won’t put your house at risk since no collateral is needed. Most banks offer amounts from €1,000 up to €25,000 for home fixes. The loan terms typically run 1-5 years.

2. Secured Home Loans

You can add your roof loan to your mortgage, which can drop interest rates to 3-5%. This option spreads payments over many years, making monthly costs much lower. Some lenders offer special home improvement loans using your house as backup. The downside lies in the paperwork and longer approval times.

3. Credit Union Options

Many local credit unions often beat bank rates by 1-3% on similar loans. They look beyond pure credit scores when making decisions. Many credit unions offer special home repair packages with flexible terms. Members sometimes qualify for loans when banks say no.

4. Green Upgrade Funding

SEAI grants can cover €1,500-€6,000 of costs for added insulation. Some banks offer green loans at rates 2% lower than standard fixes. These loans help pay for solar panels or better roof insulation.

Grants and Support in Ireland for Roof Work

Most homeowners do not have to foot the entire cost of roof repair alone. The SEAI provides grants that can cut your bill by thousands. You could receive €1,300 when you include quality attic insulation as part of roof repairs. Their solar panel assistance provides up to €2,400 for systems installed on newly repaired roofs. Most grants pay for around 30% of the total cost of the job if done properly.

Mayo County Council provides up to €8,000 for necessary roof repairs on old houses. Cork City has a repair and lease scheme that pays you up to €60,000 if you lease the repaired home. These programs tend to focus on houses at least 30 years old with obvious roof damage.

The Home Renovation Incentive allows you to claim back tax on the cost of repairs. This can save you 13.5% on charges of between €4,405 and €30,000. Most banks now partner with the SEAI to provide reduced rates of loans for green roof improvements.

Age Friendly Ireland operates a care and repair scheme in the majority of counties. They assist older people with small roof work at a very low cost. Some country homes could be eligible for Leader Programme grants that pay for roof repairs on farm buildings. The Better Energy Warmer Homes initiative pays for roof repairs in full for those on welfare support.

When Should You Take a Loan for Roof Repairs?

Storm damage must often be repaired in days, not months. The weather does not wait for you to accumulate money to pay for emergency repairs. Most specialists recommend borrowing only when your savings are inadequate. The cost to repair an average roof varies from €2,000 to €8,000. Not many families have that kind of ready money for unexpected home issues.

Small roof problems become gigantic bills if neglected for too long. A €600 fix this month could save you €6,000 a year from now. Water that seeps behind damaged tiles ruins wooden beams in the years that follow.

Most borrowers only borrow what they require for the job. You can obtain estimates from three roofers. You can also include a 10% buffer to take care of unexpected problems they may encounter. Don’t fall into the trap of borrowing excess “just in case” or for other jobs.

Summer loans enable you to fix when prices remain lower and work is quicker. Optimal loan timing coincides with when good roofers have available schedules.

Conclusion

You can compare at least three options before signing any loan papers. Your roof protects everything you own, so fixing it matters deeply. You can choose loans with no early payment fees whenever possible. Most roof loans should match your budget without cutting into basic needs.

Caleb works as a senior content writer at Loanstopocket for the past 3 years. He is a writing enthusiast and invests a good time in exploring and writing about financial trends. His keenness in exploring a topic to create a research-based piece is simply unmatched. He believes in including a texture of authenticity with real-time examples and facts.

Caleb’s blogs and articles reveal deep-seated knowledge and expertise. His educational qualification forms the base of his excellent command over the industry and Jargon. He is a postgraduate in Finance and is currently involved in exploring the world of the stock market.