New entrepreneurs are usually being tugged in two very contrasting directions. Friends and books advise them to invest all of their funds back into growth right now. But fear advises them to save for the lean years ahead. This tension makes the first year particularly difficult for most owners.

The first year informs you what is good and what is bad about any business. Sales trends start to emerge, and seasons of peak sales become obvious with experience. These early indicators prompt shrewd owners to determine where to spend money next in the business.

Most companies earn little money during their first year since they are laying the foundation for future success. Every dime counts when few are being brought in. Spending versus splurging can be the difference between growing and having to close.

When Does Quick Help Make Sense?

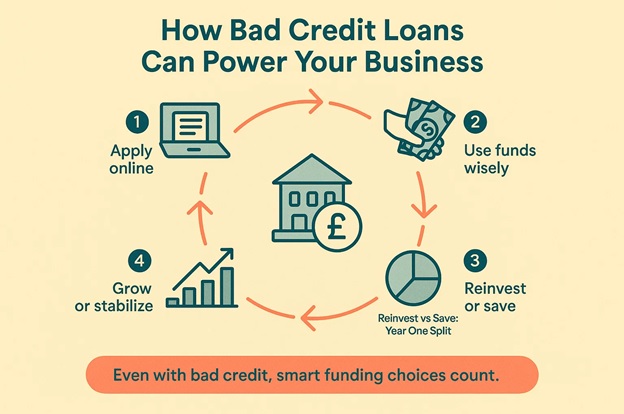

There are some growth opportunities currently available, and businesses need money to take advantage of them. An excellent new employee might be available only days before another organisation employs them. An instant loan in Ireland provides businesses with the instant money they need to seize these limited chances.

The most favourable terms are generally reserved for those individuals who can pay in cash today without hesitation. Entrepreneurs extend deep discounts to them. Short-term borrowing enables firms to be cash buyers and receive the best terms in bad situations.

Long waiting times kill many deals that would make new businesses grow more quickly. Banks typically take weeks to fund new business loans. Online lenders shorten the waiting time to hours, not letting deals fall through due to slow funding.

|

Aspect |

Details |

|

Loan Amount |

€100 – €5,000 (sometimes up to €10,000) |

|

Approval Time |

Within minutes to a few hours (same-day payout possible) |

|

Repayment Term |

1 – 24 months (depends on loan amount and lender) |

|

APR Range |

39.9% – 299%+ (short-term, higher cost) |

|

Credit Check |

Soft or none with some lenders |

|

Collateral Required |

No (mostly unsecured) |

|

Eligibility |

18+, Irish resident, proof of income, active bank account |

What is Real Profit in the First Year?

New businesses tend to combine the money they have available with the real profit money they can spend. This mix-up causes them to spend money that they should save for another time. Most owners learn this the hard way through a cash shortage they might have otherwise avoided.

Your books could be making money, but your bank account is a different story. Customers who owe you are good on paper but not in your pocket today. The difference between what you make and what you can spend comes as a shock to many new companies.

It may prove difficult for the majority of the new firms to get the bills and revenues. The large bills precede the revenues that they assist in generating, and these have not yet recovered. This lag makes it difficult to determine whom to pay first and what can be postponed.

- Cash left after deducting tax, rent, equipment, and employees.

- Do not include outstanding or stock payments in cash

- Save a minimum of 3 months’ worth of necessary expenses.

- Know the distinction between cash flow and net income.

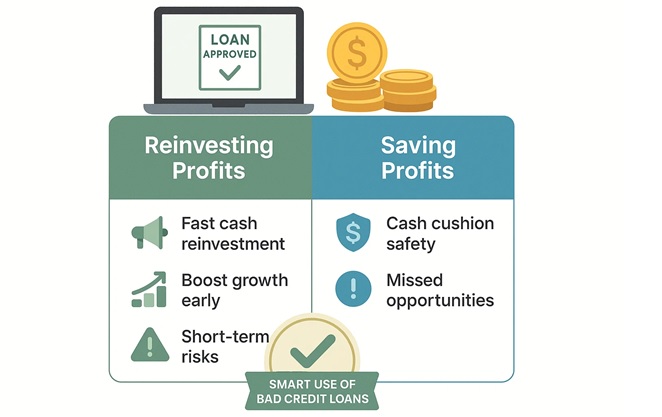

When to Reinvest Your Profits

Growth requires fuel, and cash is the prime fuel most start-ups can access. Investing in what is currently working enables great companies to become better companies in the long run. The key is to know what aspects of your company will grow the most with additional money.

Things that make you work quicker typically end up saving you money in the long term. A tool that halves the time required for a job enables you to do twice the jobs. It is easy to see the advantage when you look at the hours saved versus the cost.

Customers view corporations that continue improving each month as they expand. They like the fact that their money is used in creating something better each month. This positive mindset creates word of mouth that drives new sales at no additional cost of advertising.

- To purchase tools or technology that save money immediately.

- When demand is rising and supply is not available

- When workers need training to be faster

- If new leads or new ads have performed exceptionally well

When It’s Smarter to Save Than Spend

Incoming and outgoing cash can be extremely unpredictable, particularly at the start of most businesses. A single big customer who pays late can turn an entire month of prudent planning upside down. Having funds in reserve reduces these issues without the need for a loan.

Online bad credit loans assist when necessities don’t wait. The loans are more interested in what you’ve sold lately than in what you did or didn’t do years ago. The emphasis is on your recent business performance, not on previous financial issues, which gives new hope.

Old credit issues need not prevent your business from obtaining assistance when you truly need it. Most online lenders are willing to assist businesses that banks would turn down due to previous problems. This new direction provides young companies with a fair opportunity based on what they are currently doing.

- Revenue is unbalanced month by month

- Big bills like taxes or payments to suppliers are impending.

- Your business experiences seasonal slumps; you need to budget for

- Growth feels rapid or forced rather than occurring spontaneously.

Mix Strategy: Share Profits for Flexible Use

Keeping money reserved for unforeseen opportunities makes companies agile. The most profitable opportunities usually arrive unexpectedly and need to be seized immediately. Having cash reserved enables you to act while others wait for loans to be approved.

Saving money allows you to turn down bad terms or deals. Firms in financial trouble will accept bad terms simply in order to survive from day to day. Having the ability to walk away from bad deals has a tendency to direct you to far better ones.

Having clear direction on where profit lands eliminates stress in decision-making. You are on track with your plan and not making it up. This enables you to sleep well at night, knowing you have a good system.

Conclusion

Setting aside some cash gives peace of mind during slow sales weeks. Even small amounts saved each week add up to a helpful safety net. Having this backup lets owners sleep at night when client payments run late.

Caleb works as a senior content writer at Loanstopocket for the past 3 years. He is a writing enthusiast and invests a good time in exploring and writing about financial trends. His keenness in exploring a topic to create a research-based piece is simply unmatched. He believes in including a texture of authenticity with real-time examples and facts.

Caleb’s blogs and articles reveal deep-seated knowledge and expertise. His educational qualification forms the base of his excellent command over the industry and Jargon. He is a postgraduate in Finance and is currently involved in exploring the world of the stock market.